Ethereum, the second-largest cryptocurrency by market capitalization, has long captivated the minds of miners and investors alike. At its core, Ethereum’s ecosystem thrives on a delicate balance between mining difficulty and profitability—a relationship that dictates the viability of operations for those wielding powerful mining rigs. As we delve into this intricate connection, imagine the hum of servers in vast mining farms, where every computational effort translates into potential rewards. But what exactly links the escalating difficulty of mining Ethereum to the fluctuating profitability that keeps enthusiasts on their toes?

Mining difficulty, in essence, is a measure of how challenging it is to solve the complex cryptographic puzzles required to validate transactions and add new blocks to the Ethereum blockchain. This parameter adjusts approximately every two weeks, scaling up as more miners join the network with their advanced hardware. For Ethereum miners, this means that what was once a straightforward path to earning Ether (ETH) can quickly become a high-stakes gamble. Profitability, on the other hand, hinges on factors like electricity costs, hardware efficiency, and the current price of ETH. When difficulty rises, the competition intensifies, demanding more from your mining rig and potentially eroding profits if not managed wisely.

Consider the broader landscape of cryptocurrencies: Bitcoin (BTC), with its proof-of-stake transition on the horizon, offers a stark contrast to Ethereum’s current proof-of-work model. While BTC miners grapple with their own difficulty adjustments, Ethereum’s shift towards proof-of-stake in the upcoming Ethereum 2.0 upgrade could redefine profitability entirely. This evolution might render traditional mining rigs obsolete, pushing users towards staking instead. Yet, for now, the allure of ETH mining persists, especially for those who have invested in top-tier mining machines capable of handling increased difficulty without breaking the bank.

In the world of mining machine hosting, companies like ours play a pivotal role. By offering secure, energy-efficient hosting services for your miners, we help mitigate the risks associated with soaring difficulty levels. Picture a state-of-the-art mining farm buzzing with activity, where hundreds of rigs operate in harmony, their combined hash power turning potential losses into gains. This is where the unpredictability of profitability meets strategic planning—hosting allows miners to avoid the overhead of personal electricity bills and maintenance, focusing instead on the ever-changing dynamics of the crypto market.

Let’s not overlook other currencies in this ecosystem. Dogecoin (DOG), born from internet memes, has seen its own surges in mining activity, though its lower difficulty makes it an accessible entry point for beginners. Unlike Ethereum, where profitability can dip due to rapid difficulty spikes, DOG mining often rewards persistence with quicker block rewards. However, the volatility of DOG’s price can make long-term profitability as elusive as chasing shadows. This diversity in the crypto space—spanning ETH, BTC, and DOG—highlights how mining difficulty isn’t a isolated metric but a interconnected web influencing everything from individual miners to global exchanges.

Diving deeper, the profitability equation for Ethereum involves calculating metrics like hash rate efficiency and return on investment (ROI). A miner’s hash rate, the speed at which their rig solves puzzles, directly combats rising difficulty. If your hardware lags behind, profitability plummets; but with cutting-edge mining machines from trusted providers, you can stay ahead. We’ve seen instances where a sudden Ethereum price rally offsets increased difficulty, turning what seemed like a loss into a windfall. This burst of market energy keeps the sector alive, unpredictable, and endlessly fascinating.

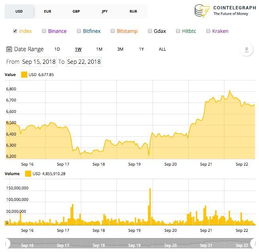

Moreover, exchanges like Binance or Coinbase amplify this connection by providing real-time data on ETH prices and mining rewards. Miners often use these platforms to sell their earned ETH, converting digital gains into tangible profits. But beware: as difficulty climbs, so does the need for sophisticated strategies, such as diversifying into multi-currency mining rigs that can switch between ETH, BTC, or even DOG based on profitability forecasts. It’s a rhythm of adaptation, where one day’s triumph could be tomorrow’s challenge.

At our company, we specialize in not just selling high-performance mining machines but also in hosting solutions that optimize for these fluctuations. Whether you’re running a solo operation or managing a large-scale mining farm, understanding the Ethereum difficulty-profitability link is crucial. By leveraging our services, you can navigate the ebbs and flows with greater ease, ensuring your investments yield fruitful returns amidst the crypto chaos.

In conclusion, the interplay between Ethereum’s mining difficulty and profitability is a testament to the dynamic nature of cryptocurrencies. As difficulty escalates, profitability demands innovation, from upgrading your miner to exploring hosting options that reduce operational costs. While BTC and DOG offer alternative avenues, Ethereum remains a cornerstone for many, its ecosystem evolving in ways that promise both risks and rewards. By staying informed and equipped, miners can transform this connection from a mere challenge into a pathway for sustained success.

Leave a Reply